CryptoNews of the Week

StanNordFX

Publish date: Thu, 09 May 2024, 02:36 AM

– Anthony Pompliano, founder of Pomp Investments, asserts that bitcoin is "stronger than ever." This conclusion is based on the 200-day moving average (200 DMA) reaching its all-time high above $56,000. "In the long term, digital gold continues to appreciate. It is misleading to comfort oneself with the idea of a sideways trend. The long-term thesis is stronger than ever," the expert stated.

– Willy Woo, analyst and co-founder of CMCC Crest, has highlighted the activity of so-called crypto 'dolphins' and 'sharks.' "There has never been such vigorous coin accumulation by wealthy holders as in the last two months, with prices fluctuating between $60,000 and $70,000. These are individuals who hold between 100 BTC and 1,000 BTC, or approximately $6.5 million to $65 million," he explained. Willy Woo anticipates that bitcoin will continue to penetrate various aspects of daily life, thereby increasing the number of users. "By 2035, we expect the fair value of bitcoin to reach $1 million. This forecast is based on the user growth curve, and I am talking about fair value, not the peak during a bull market frenzy. Bitcoin was not traded until the thousandth user appeared, and only after the launch of the cryptocurrency exchange Bitstamp in 2011 did global platforms for asset valuation emerge. Since 2012, the BTC price has largely matched the growth in user numbers," noted the analyst.

– According to analysts at CryptoQuant, whales holding between 1,000 and 10,000 BTC, unlike dolphins and sharks, behave quite passively. Meanwhile, Michael Van De Poppe, founder of MN Trading, has pointed out the "absence of retail investors." He predicts that in the event of another correction, the coin could drop to around $55,000. "However, this range is quite acceptable as long as bitcoin remains above $60,000. Altcoins are slowly awakening," he added.

– Trader and analyst known as Rekt Capital reported that the first cryptocurrency has exited the post-halving "danger zone" and entered a phase of reaccumulating. According to this expert, in 2016, after the halving, BTC demonstrated a long red candle on the weekly chart, decreasing by 17%. This time, however, the pattern repeated with a correction of just 6%. The price reached a local bottom at around $56,500 but then increased by 15% and re-entered the "reaccumulating range." The analyst warned that technically, the "danger zone" will continue until the end of this week when the third post-halving weekly candle closes. From a price perspective, the "reversal effect" has already occurred.

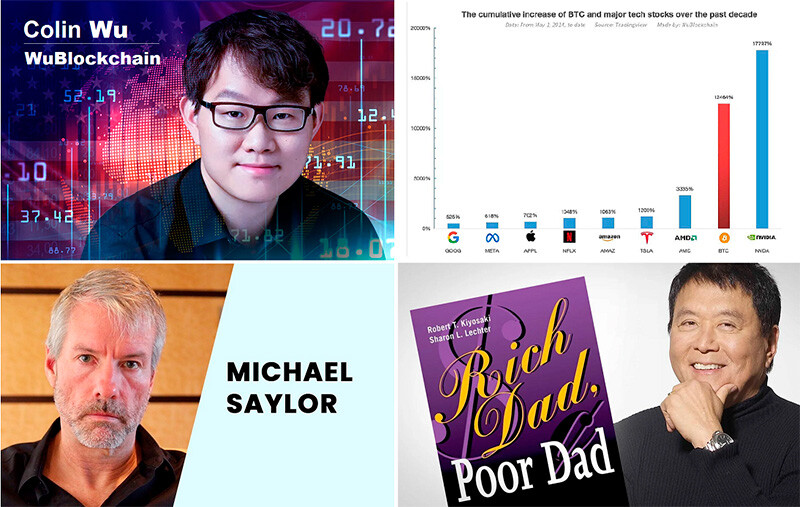

– Robert Kiyosaki, bestselling author of "Rich Dad Poor Dad" and entrepreneur, has declared a crash in the currency market. "Bad news: the crash has already begun. It will be severe. Good news: a crash is the best time to get rich," he wrote, offering several recommendations on how to act during a crisis. The first recommendation is: "Find an additional source of income. Artificial Intelligence will destroy millions of jobs. Start a small business and become an entrepreneur rather than an employee who fears losing their job." The second advice from Kiyosaki is: "Do not save fake money (US dollars, euros, yen, pesos) which are declining in value. Save gold, silver, and bitcoin – real money whose value increases, especially in market crash conditions."

– Over the last decade, the main cryptocurrency has risen by an astonishing 12,464%, surpassing tech giants such as Amazon, Alphabet, and Netflix. However, according to a study by WuBlockchain, Nvidia shares took the lead, showcasing an even more impressive growth of 17,797%. This was facilitated by the company's cutting-edge graphics processors and semiconductor devices. The fact that bitcoin secured the second place, being a representative of a highly volatile market, is a true achievement. The impressive growth trajectory of BTC over the last decade demonstrates its resilience and potential as a viable investment vehicle. Given that investors are actively diversifying their portfolios and seeking ways to achieve potentially high returns, the analysis conducted by the WuBlockchain team serves as a valuable reference point that highlights the impressive dynamics not only of traditional tech company stocks but also of modern digital assets.

– According to data from Clark Moody, more than 1 billion transactions have already been processed in the bitcoin network. Comparing network indicators with the international payment system Visa, it is notable that the first cryptocurrency's blockchain reached the billion milestone in just 15 years, while Visa required almost a quarter of a century. The average number of daily transactions in the BTC network, as detailed by The Block, is around 505,000, which is a sign of growing recognition for "digital gold." It should be noted that bitcoin is not the record holder in this indicator: the Ethereum network currently has around 2.4 billion transactions.

– On May 1, bitcoin updated the minimum from April 17-19, which has heightened investor concerns. Amid such fluctuations, Michael Saylor, CEO of MicroStrategy, has become a symbol of bullish optimism. In his latest message, he urged investors to "run with the bulls." It should be noted that with 205,000 BTC on its balance sheet, Saylor must exude optimism to prevent his company from incurring losses. However, analysts note that in reality, the fate of bitcoin depends not only on the sunny calls of the CEO of MicroStrategy. If buyer support weakens, BTC may return to key support levels at $61,000 and $56,000, where significant liquidity is concentrated.

– American and British scientists have published a study titled "The Impact of Cryptocurrency-Generated Wealth on Purchasing and Investment in Private Residences." The researchers examined financial transaction data for more than 60 million residents of the USA conducted from 2010 to 2023 and found that the rise in cryptocurrency prices causes a significant increase in real estate prices. In states such as California, Nevada, and Utah, where many residents became wealthy in 2017 due to the multiple increase in BTC prices, the value of real estate increased by an average of $2,000 annually, and every dollar earned from cryptocurrencies increased property prices by 15 cents.

Notice: These materials should not be deemed a recommendation for investment or guidance for working on financial markets: they are for informative purposes only. Trading on financial markets is risky and can lead to a loss of money deposited.

#eurusd #gbpusd #usdjpy #btcusd #ethusd #ltcusd #xrpusd #forex #forex_example #signals #cryptocurrencies #bitcoin #stock_market